The Construction industry has long been a foundation stone in modern economies. You would expect taxation methods and practices to have been well-understood and formalized among most construction firms, especially those involved in numerous and large projects. But a recent draft ruling from the Australian Tax Office (ATO) shows that these methods are well-worth reviewing.

The Key Concern

Essentially, the ruling raises one key question: are you employing a common yet ultimately incorrect tax and accounting approach to your long-term construction contracts?

If so, you might need to take a step back. A revision of your tax and accounting plan for long-term and lucrative contracts involves a rethink of your overall business strategy. It may well require the expert services of a Virtual CFO in Australia.

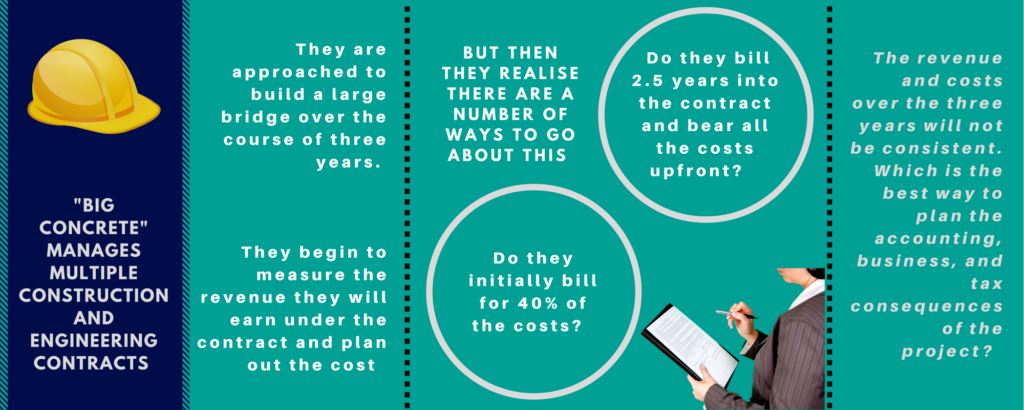

For example

As you can imagine, these questions (and their subsequent answers) do not simply apply to the building of one bridge. Big Concrete needs to work out the best way of managing their finances, budgets, and taxes across the length of all their ongoing contracts. This is a matter of making the best choice about revenue that potentially adds up to millions of dollars.

And this is why it behooves you to consider a Virtual CFO. Australia has top notch accountants, but to consider the best overall financial and tax strategy for the long-term, its best for construction companies to utilize the expertise and broad experience of a Chief Financial Officer outsourced for this specific purpose.

What’s the Right Approach?

Essentially, the ATO Draft Ruling outlines two methods of handling the revenue and costs of a construction contract that runs over two or more income years. The basic approach accrues revenue and costs over time as they occur while the estimated profits approach plans ahead for the entirety of the contract period. Which is right for you? It depends on your project, and it depends on your business. In any case, you need to pick an approach and stick to it. The ATO expects consistent application of an approach across all your contracts.

Is there a Wrong Approach?

The Draft Ruling does also outline a number of approaches that the ATO refuses to accept for such long-term projects. For example, the completed contracts method involves bringing profits and losses to account when the contract is completed, and so positions the planning at the end of the project.

To know which approach works in the ATO’s eyes, and to understand which approach you are using consistently, you need to chat with your tax accountants.

A Way Forward in the New Year

Are you involved in any long-term construction projects? Have you outlined the best accounting and tax approach, measured it in line with the ATO’s rules, and applied it consistently across your business? As the new year starts, this should top your agenda. And, due to the potential complexity of the issue and the way it can affect a broad scope of your business, not to mention a considerable amount of money, it is also wise to explore options regarding a Virtual CFO to help sort out such plans and bring them to proper and profitable fruition.

Important Disclaimer: Readers should not act solely on the basis of the material on this page. Items herein are general comments only and do not constitute or convey advice. Legislation and proposals of legislation are also subject to constant change. We therefore recommend that formal advice be sought before acting in any of the areas. This news article is issued as a guide to the readers. Calibre Business Advisory Pty Ltd and its associated entities disclaims any losses that may be incurred as a result of the reader undertaking any action based on this article.