The Research and Development Tax Incentive has been a boon to many businesses. For those driven by innovation, it is of obvious benefit. By engaging in scientific innovation and pushing for new knowledge that arms fresh business products and services, innovative companies can tap into a R&D Tax Incentive Rate of up to 43.5%.

Moreover, many companies have been surprised to find that they are eligible. The R&D Tax Incentive doesn’t just help tech start-ups; many companies can gain an edge in their niche markets by coming up with original, tested ideas, and the government has been keen to help fund them to do this.

But as the saying goes, there is no such thing as a free lunch.

ATO investigates R&D tax offset claims

The ATO has been issuing warnings to R&D claimants. They are especially targeting claims from software companies amid a concern that a number of claimants are ripping-off the system. One of the key reasons that such a crackdown has been initiated is the worry that software firms are claiming beta-testing as R&D. The generous R&D tax incentive rate applies to business actions that employ scientific tests whereby the outcome cannot be known in advance. It involves experimentation, technological risk. Most beta-testing, on the other hand, involves merely the testing of commercial risk.

What exactly is the ATO cracking down on?

- Software R&D claims: there is a fine line between building software which is empirically tested R&D and customizing existing software

- Companies that have been claiming R&D for multiple years and been receiving refunds because their businesses are not generating profits. The ATO wants to know where all the cash from the R&D Tax Incentive Rate is going.

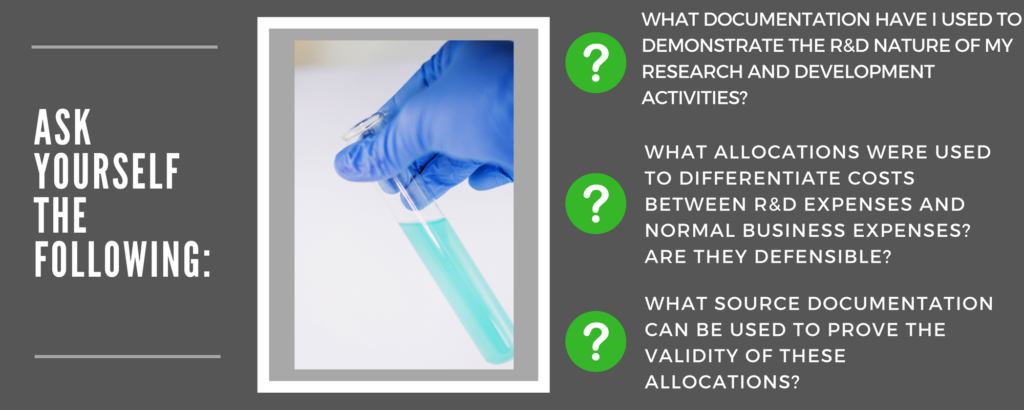

- Companies over-claiming expenditure for R&D. This happens when it is not segregated between normal business activities and R&D activities. This applies to existing businesses (not start ups) which have R&D activities.

Should I be concerned?

Some, especially among tech start-ups, are worried about a wave of audits sparked by the ATO crackdown. This may make many current R&D Tax Incentive claimants nervous, and may very well put you off applying in the future. But the key lies in the small business grant specialist you have used to substantiate your claim and apply. Reliable and reputable firms will only help you apply if you can document and delineate with accuracy that you have engaged in core and supporting R&D activities as defined by the Federal departments and bodies which manage the scheme.

The R&D Tax Incentive Rate gives you a generous rebate of 38.5% or 43.5%. It is well worth considering, especially for small businesses and start-ups. It can not only give you a boost of funds but also give you the edge of innovation in your market. But the recent ATO crackdown should be a warning to steer clear of unreliable R&D claim assistance. Calibre Business Advisory has small business grant specialists who can help you apply the right way, which also helps ensure that your claim doesn’t attract the unwanted attention of the ATO.

Important Disclaimer: Readers should not act solely on the basis of the material on this page. Items herein are general comments only and do not constitute or convey advice. Legislation and proposals of legislation are also subject to constant change. We therefore recommend that formal advice be sought before acting in any of the areas. This news article is issued as a guide to the readers. Calibre Business Advisory Pty Ltd and its associated entities disclaims any losses that may be incurred as a result of the reader undertaking any action based on this article.