Then you need to know about these two taxation developments and their implications.

Increased Scrutiny Means You Must Ensure You Are Paying Payroll Tax for Contractors

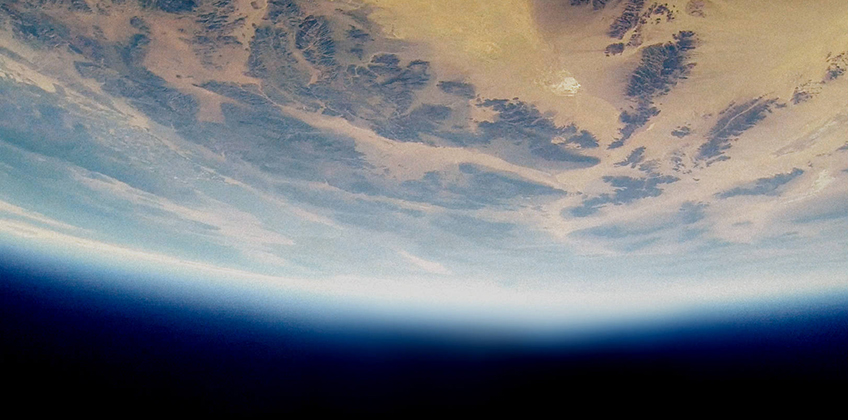

Do you hire contractors? There is common misconception that payroll tax doesn’t apply to contractors. Many believe that you are only required to consider payroll tax for direct employees. But this is not true, and, increased audit activity by the NSW Office of State Revenue means businesses who don’t pay payroll tax for contractors are at risk of being assessed for payroll tax and possible penalties.

This increased scrutiny is particularly targeted at industries such as construction, building services, education, hospitality, and cleaning, where contract labour is common.

The consequences for not paying the appropriate payroll tax are severe. So, it is more important than ever to ensure that your business is meeting its tax requirements in regards to contractors that you hire.

Key questions you need to be able to answer about your payroll tax

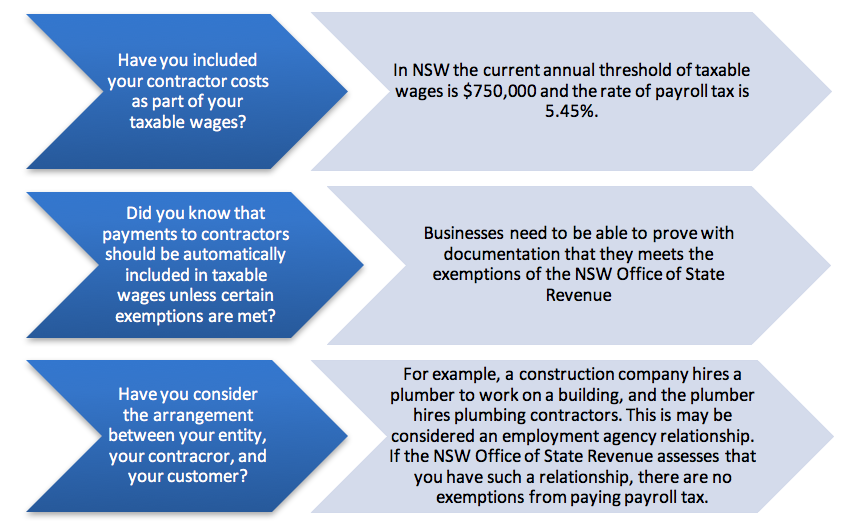

Since there are no exemptions from payroll tax if you have an employment agency relationship, it is vital that you understand the criteria for determining this relationship.

How the NSW Office of State Revenue determines if you have an employment agency relationship with your contractors

You need to consider these questions to determine if you are in an employment agency relationship.

Calibre has had significant experience in advising clients regarding payroll tax. We can help determine if you meet exemptions or the above criteria for an employment agency relationship with your contractors. We have also represented a number of clients in NSW Office of State Revenue audits and objections. Please contact us if you have contractor arrangements and are concerned about your payroll tax situation.

Tax changes for transactions between Australian companies and related overseas entities

If you have transactions or dealings with related overseas parties, any transfer pricing benefits you may have might be eliminated and adjusted to reflect arm’s length conditions.

Who is Affected?

Australian entities that deal with an overseas entity that is related to them.

What is Affected?

Any transaction between an Australian entity and a related overseas party – which can involve sale of goods, and services, loans, royalties, and other dealings.

How are Your Transactions Affected?

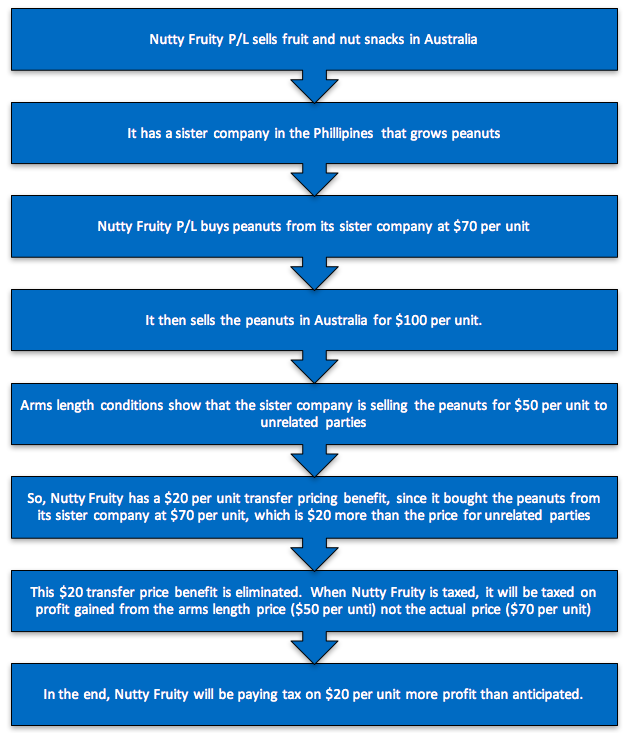

The taxpayer has to ensure that the price on transactions is the same as the price given to parties who are at arm’s length – in other words, parties who are unrelated. They need to prove this by maintaining documentation. If the pricing terms are different then there is a transfer pricing benefit. In this case, then the arm’s length pricing is considered for tax purposes.

For example…

As seen from the example, these changes could increase the tax you pay on international transactions. It is up to you to demonstrate that the actual conditions of any transactions you make match the arm’s length conditions inherent to transfer pricing rules.

Documentation must be maintained and provided about transfer pricing benefit in these transactions. The ATO has simplified the once onerous requirements for this documentation. Penalties can be imposed by the ATO if the appropriate documentation is not supplied on time.

To check if your international transactions are affected, and to prepare the relevant documentation, contact your Calibre Advisor. Calibre has experience in developing transaction pricing strategy, maintaining documentation, working out and benchmarking arm’s length conditions, and represent you during ATO audits.

Important Disclaimer: Readers should not act solely on the basis of the material on this page. Items herein are general comments only and do not constitute or convey advice. Legislation and proposals of legislation are also subject to constant change. We therefore recommend that formal advice be sought before acting in any of the areas. This news article is issued as a guide to the readers. Calibre Business Advisory Pty Ltd and its associated entities disclaims any losses that may be incurred as a result of the reader undertaking any action based on this article.