A tax accountant turns crypto-nonsense into facts: how much tax will I end up paying on my cryptocurrency gains? A cold, hard look at cryptocurrency in tax terms can give you certainty in an arena of big promises.

The boom behind bitcoin

In 2009, when bitcoin launched, its peer-to-peer blockchain transactions attracted those who wished to avoid traditional financial intermediaries. Barely recognised by the banks and the general populace, it drew attention from people who had a degree of contempt for fractional-reserve banking.

Back then, many a business advisor or tax accountant would have had little to no idea how the technology generated value and its implications for business.

But last year’s spike in value has fuelled interest. Now the bitcoin craze is well and truly underway. Nearly 6 million users have a cryptocurrency wallet, and the general public is intrigued with countless news articles touting or slamming its worth. The lure of ‘bitcoin millionaires’ and dreams of making quick money on this volatile investment have drawn in countless people who have bought bitcoins without fully grasping the principles behind how a blockchain derives and secures value.

Ethereum, Bitcoin Cash, Ripple – more and more cryptocurrencies and their variants have hit the market, and it looks like the media interest and popular excitement is going nowhere in the short-term. Blockchain technology once touted on reclusive internet forums as the harbinger of the final days of the financial system is now recognised by nearly 100,000 businesses and is exchanged and used much like a currency.

So, how much profit do I keep?

Bitcoin and other cryptocurrencies can be used in a similar way to cash. The key difference lies in oversight. Rather than utilising a centralised, national bank and financial system, this digital coinage uses blockchain technology. Users set up computers to mine bitcoin by solving algorithms called blocks, and once a block is decrypted the user has the digital coins deposited into their bitcoin wallet.

The value of the coins is not based on the health of any economy; rather, it’s based on digital effort of miners and their computer rigs, and on the blocks they eventually decrypt and add to the overall chain.

Increasingly, however, people are simply exchanging bitcoin for cash. Small time investors, curious hobbyists, people who want to put their money into something that hints at a quick, significant return – these are the new breed of bitcoin enthusiasts.

It simply takes too much time and CPU effort to mine bitcoin and unearth new blocks. So, bitcoin by name, bitcoin by nature – people see it as buying a currency, and more often than they don’t intend to use it to buy and sell primarily. Instead, they want the value to rise so they can turn a profit.

And this is why it is prudent to talk to a business advisor. Sydney, Melbourne, and all of Australia is increasingly being lured with stories of people investing and making some solid returns – but how does all this work in the eyes of a business and financial expert?

Like any other currency, speculation has its inherent risk, as the recent drastic drop in value (following recent national bans of bitcoin) makes all too clear. The blockchain is not backed up by banking reserves and the BTC market is exceptionally volatile.

But let’s say you’ve done your homework, you’ve bought bitcoin, and you’ve seen its value increase in the short-term. You want to now exchange this value back into cash. How much of that money will go to the Tax Office?

The speculative and volatile nature of cryptocurrency is one thing; the cold, hard reality of being taxed is another. How much you pay depends on whether your bitcoin earnings are considered capital gains or not.

How does the ATO see your bitcoins?

The debate still rages over whether or not cryptocurrency is actually currency. The initial response from the powers-that-be was suspicion. Many financial institutions did not recognise the mining or exchange of bitcoin, but that mentality has begun to shift somewhat.

From a tax point of view, the question is more precise. Is bitcoin and cryptocurrency seen as a currency or an asset. Are you going to have to pay GST on the transactions or are you liable only for Capital Gains Tax? This is where a tax accountant’s advice can come in handy.

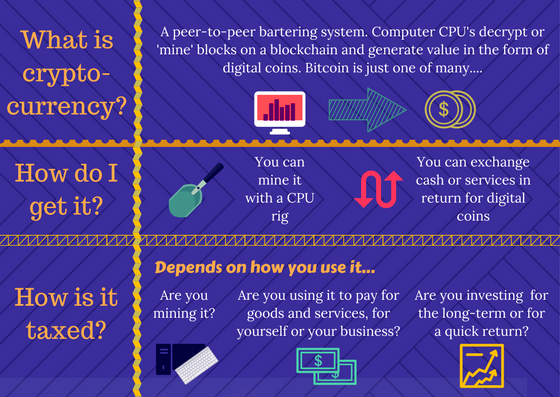

The ATO sees cryptocurrency as akin to a barter arrangement. As such, for the tax office bitcoin is neither money nor a foreign currency, so its supply is not a financial supply for goods and services tax (GST) purposes. It counts as an asset for capital gains tax (CGT) purposes.

The tax office explores roughly three ways people use this asset. You can use cryptocurrency as a form of payment in exchange for goods and services, you can set up a bitcoin rig and mine it, or you can get hold of it as asset that you expect to rise on value and then exchange your coins for a nice cash profit.

Taxes on transactions made with Cryptocurrency

You don’t need to worry about the GST when transacting in bitcoin for personal use:

- If you simply pay for goods or services in bitcoin acquiring personal goods or services on the internet using bitcoin, there will be no income tax or GST implications

- Where you receive bitcoin from sales of assets kept for personal use or consumption, any capital gain or loss from disposal of the bitcoin will be disregarded (as a personal use asset) if the cost of the bitcoin is $10,000 or less.

- There are no GST consequences where the bitcoin is not supplied or acquired in the course or furtherance of an enterprise you are carrying on.

However, things are a little different when transacting in bitcoin for business purposes:

- Ultimately, the ATO wants to see business transactions made in cryptocurrency accounted for in Australian dollars, just as with any other non-cash barter exchange.

- GST is payable on the supply of bitcoin made in the course or furtherance of your enterprise. GST is calculated on the market value of the goods or services. This is ordinarily equal to the fair market value of the bitcoin at the time of the transaction.

- Where you are carrying on a business and purchase business items using bitcoin (including trading stock) you are entitled to a deduction based on the arm’s length value of the item acquired.

Taxes on Mining bitcoin

Mining bitcoin is essentially considered a business enterprise:

- Bitcoin held by a taxpayer carrying on a business of mining and selling bitcoin, will be considered to be trading stock.

- Any income a business derives from the transfer of the mined bitcoin to a third party would be included in your assessable income, while expenses would be allowed as a deduction and losses may also be subject to the non-commercial loss provisions.

- GST is payable on the supply of bitcoin made in the course or furtherance of your bitcoin mining enterprise. Input tax credits may be available for acquisitions made in carrying on your bitcoin mining enterprise. There may also be capital gains tax consequences where you dispose of bitcoin as part of carrying on a business. However, any capital gain is reduced by the amount that is included in your assessable income as ordinary income.

Taxes on buying and selling bitcoin as an investment

The key issue here is whether you have sold bitcoin as part of a long term investment strategy or whether your intent was to take advantage of the market and turn a quick profit. The tax consequences as interpreted by the ATO can be starkly different with the former considered a capital gain and the latter as an assessable. Generally, capital gains are preferable with access to the CGT discount and capital losses.

So, against the run of what seems to be popular trend, there are tax benefits to investing in bitcoin in the long-run, rather than seeking to buy it and sell it for a quick cash profit.

This brings us to a critical question that every person who sells bitcoin will need to consider – and the answer comes down to the individual circumstances relevant to you.

What is your strategy with the bitcoin investment, what is your background (are you an avid investor with prior experience trading on markets or a conservative investor doing bitcoin on the side), and have you undertaken a systematic approach to your bitcoin trade?

The fact is, buying cryptocurrency with the aim of seeing its value rise so that you can sell it at a profit means the profits you make will be considered as assessable income. If you have acquired bitcoin as an investment capital gains tax could apply. The ATO is still considering the full taxable implications of cryptocurrency. This raises the question of how budding crypto-enthusiasts should plan a way forward with the ATO in real terms.

A cryptocurrency tax strategy

This now or never mentality should put a smile on your face. It may be that since the year is in full swing, and your business is well and truly back at its usual operations, and you know the weeks and months will pass you by, that you feel a little overwhelmed.

The decision to invest in cryptocurrency is yours to take based on your own particular financial situation. No general advice can explain the hows, whys, and when. But the cold, hard realities of tax regulations give you some scope for planning a realistic tax strategy should you invest.

As you can see, there are added tax implications for those who use bitcoin as part of a business (for example, to pay employees, to buy equipment). Likewise, this applies to those who mine bitcoin. Essentially, the ATO wants you to account for, in Australian dollars, all the crypto-currency you use in your business and any which you may mine.

sooner or later, and make an attractive profit. Many people have already fell into the trap of saying it’s a hobby, or some form of gambling – can they avoid being taxed on the gains made?

Most likely, the answer is ‘no’.

For example, let’s say Jimmy buys $2,000 worth of bitcoins on a bitcoin exchange in 2017. He wants to keep it for long time as he believes the value will continue to go up as time progresses and mining bitcoin gets harder.

However, the value soars in the first 6 months. By December, he has $10,000. He wants to cash in on his bitcoin. But if he does so, he is likely to pay the income tax, which could be up to 46.5%. That is a significant loss to his take-home return on his investment.

If, on the other hand, he waits a year, then he can benefit from the 50% CGT rate discount – but, as the recent savage drop in the value of bitcoin has shown, can he afford to wait that long? Is he better of using the $10,000 dollars’ worth of bitcoin he now has to buy goods and services, which will be recognised by the ATO as a form of personal barter?

It’s vital to seek the right advice when making any investment. Many people will have no trading experience whatsoever but will want to see if they can cash in on the cryptocurrency craze. Others still will consider using bitcoin to make transactions, either personally or part of their business. Still others may take the leap, invest in an effective CPU rig, and mine away at decrypting blocks.

The future of cryptocurrency might be highly debatable, but a solid business advisor or outsourced CFO can bring clarity amid the craze.

Important Disclaimer: Readers should not act solely on the basis of the material on this page. Items herein are general comments only and do not constitute or convey advice. Legislation and proposals of legislation are also subject to constant change. We therefore recommend that formal advice be sought before acting in any of the areas. This news article is issued as a guide to the readers. Calibre Business Advisory Pty Ltd and its associated entities disclaims any losses that may be incurred as a result of the reader undertaking any action based on this article.