We explore the financial landscape of 2016 and sum up what can be expected for small businesses in 2017. Also included is information that could impact your business in the New Year regarding ATO Surprises, the GST on Imports, and China Export Opportunities

The ATO’s Review of 2016, and a glimpse into 2017

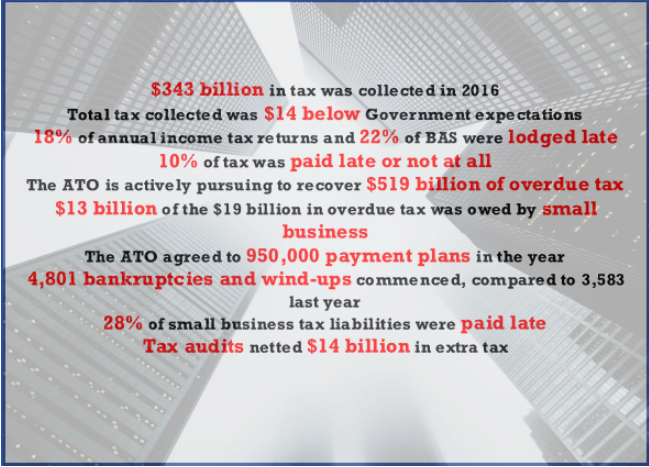

As many businesses wind up for the year, and people look ahead to well-earned holidays, some thought goes toward reflecting on the year that has nearly past. The ATO recently released its Annual Report, “Commissioner of Taxation Annual Report 2015-16.” It provides a useful snapshot of 2016.

These features of 2016 guide us on what to expect for 2017. There is clearly economic uncertainty not only in Australia, but also across the globe. As such, small to medium-sized businesses must deal with the challenges of lower business confidence. This is why managing cash flow must be a priority of all SMEs in 2017. Your company needs to ensure that it has the funds to manage expenses.

Calibre has extensive experience in assisting and helping clients manage cash flow in the midst of uncertainty and decreased business confidence.

How Small Businesses Can Be Surprised by ATO Benchmarking

Sloane and Joan run a retail bakery, Cafe Example. They are diligent and hard-working. Each year, they ensure due care is given to their tax returns. Café Example is profitable, but since they use high-quality products their expenses are higher than usual for a bakery.

In September, they find out that Café Example will be audited. The ATO observes that the income reported for the previous financial year fell well below an ATO industry performance benchmark. Sloane and Joan are expected to provide detailed documentation explaining why the reported sales of Café Example stand at only 45% of what is expected by the ATO.

Sloane and Joan are surprised and concerned. They had no idea about ATO benchmarks and now only have 21 days to respond to the audit notice…

What are ATO Benchmarks?

Performance benchmarks are employed by the ATO to target undeclared income in the cash economy. The cash economy represents any business that has dealings in cash, such as retail stores and trades. The ATO expects your business to report an income each financial year that matches the amounts in these performance benchmarks. They are based on your industry and the nature of your business operations, and are based on statistical data derived from tax return information.

If your business declares an income that is under the benchmark amount determined by the ATO, you will receive a notice. When a business’ income does not match the benchmarks slightly, an ATO exception letter is generated. If there is an extreme difference between the taxpayer’s percentages and the benchmarks, then an audit commences.

This places the onus on you. Small businesses must make sure they have documented data that explains their reported income and its sources, and must be able to explain why this income falls short of the ATO benchmarks.

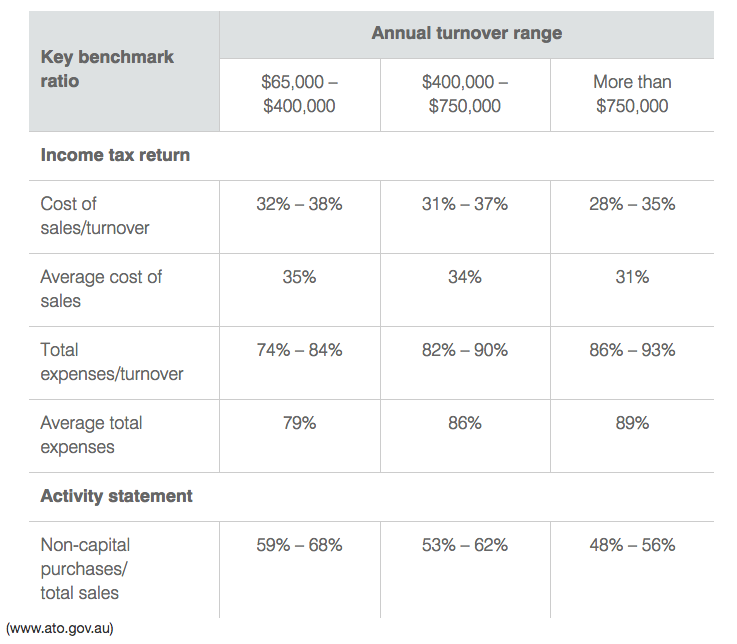

ATO benchmarks are divided into codes which pertain to industries and business descriptions. Below is an example of benchmark amounts for Bakeries in the 2013-14 financial year:

How do I avoid or respond to a notice for falling outside ATO benchmarks?

How can you avoid such an unwelcome surprise? Or, if a notice is sent in this regard, how can you respond? The key is record keeping. You must keep extensive financial records according to the expectations of the ATO. What may be unknown to many small business is that you need to keep your records with the benchmark for your industry in mind, in order to be prepared to explain any potential discrepancy

First, pay careful attention to the industry you disclose on your tax return. By telling the ATO the correct industry in which your business operates, you make sure that you are not measured by the wrong ATO benchmark. Second, review all your documentation to make sure it supports all your income, especially your cash income. For example, keep daily reconciliations of your cash and EFTPOS revenue in comparison to how much you have in the till. Third, be ready to use this thorough documentation to explain any anomalies to the ATO regarding its benchmarks and your revenue. You should be able to explain discrepancies based on circumstances, such as one off expenses, specialist products, or product shortages.

Contact your Calibre advisor to understand if you might be impacted by ATO performance benchmarking, and to ensure that your business is keeping appropriate records.

Import Costs You May Not Know About

Most importers are aware that costs are involved when buying goods overseas and selling them in Australia. But you may not be aware that the GST is part of these costs. GST is payable on imports regardless of whether or not the entity is registered (or required to be registered). You can recoup this GST payment through input tax credits paid on importation, but this option is only available for registered entities. In essence, this means Australian companies can claim back GST on business purposes, while foreign companies, who are often not registered GST, cannot.

But when both Australian companies and foreign entities are involved in importation, who pays the GST? Since there is no GST-free threshold and the GST amounts to 10% of the value of taxable importance, this question is very relevant to the profits margins of importers.

Who pays GST on Imports?

The seller and buyer must negotiate bringing imports through Australian customs. The party who is determined to be the importer (the party who brings goods into the country) bears the GST. Incoterms define who is an importer. The Incoterms most relevant to the issue of the GST are outlined below:

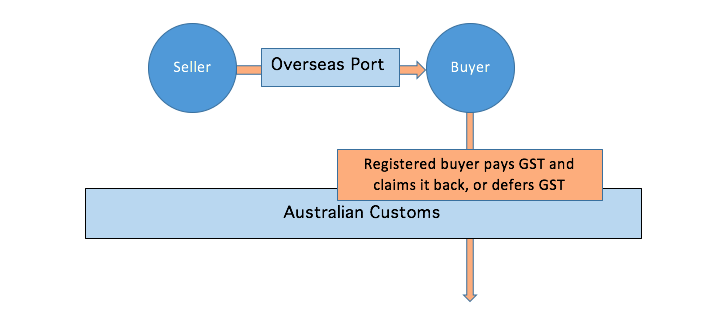

Free On Board

The buyer is responsible for the import of goods from the overseas port. In this case, a registered importer can defer paying the GST, or make the GST payment and claim it back. However, this can only happen if the goods are used in the course of your business.

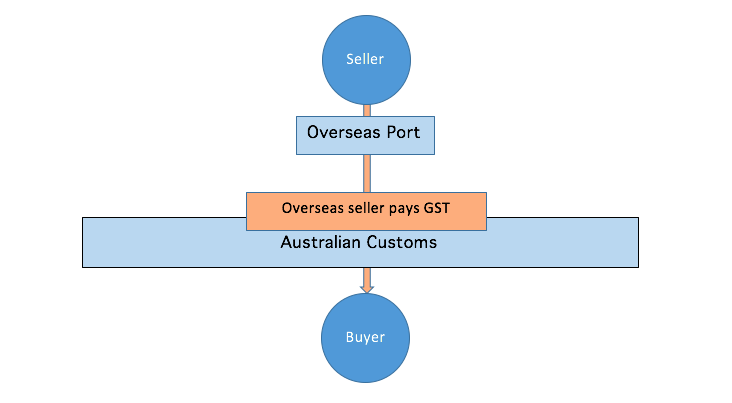

Delivery Duty Paid

The seller is responsible for the imports passing through customs. But since overseas sellers are unlikely to be registered for GST, there will be an additional cost in that the seller will have to pay the GST if the goods are used in Australia for business purposes.

Can an overseas seller claim the payment back under DDP terms?

In essence, only entities which are eligible to register for the GST can claim it back or defer its payment. There are potential means for the seller to claim back a GST payment on importations. Calibre has helped clients navigate the complicated rules governing GST on imports and has assisted companies in registering for the GST. These need to be taken into other cost considerations when managing trade and currency exchanges between two nations and separate tax jurisdictions, such as transfer pricing.

To discuss how this might affect your import activities, and to explore if and how you can register for the GST, contact your Calibre Advisor.

How Exporters Can Benefit from ChAFTA (the China-Australia Free Trade Agreement)

The free trade agreement between Australia and China came into effect on 20 December 2015. It gave Australian business access to an economy worth $A11.6 trillion. This, combined with the the capacity to utilise government funding by making an EMDG claim, means the opportunities are still there to export to China successfully.

China purchases more of Australia’s agricultural produce than any other country, and is by far our largest market for resources and energy products. It is also Australia’s largest services market; in 2014-15, exports in services to China valued $8.8 billion. ChAFTA includes a Most-Favoured Nation (MFN) clause, which protects Australia’s competitive position in the future if China offers other nations new preferential treatment in education, services relating to forestry, computer and related services, tourism and travel-related services, engineering, securities, environmental services, construction, and certain scientific and consulting services.

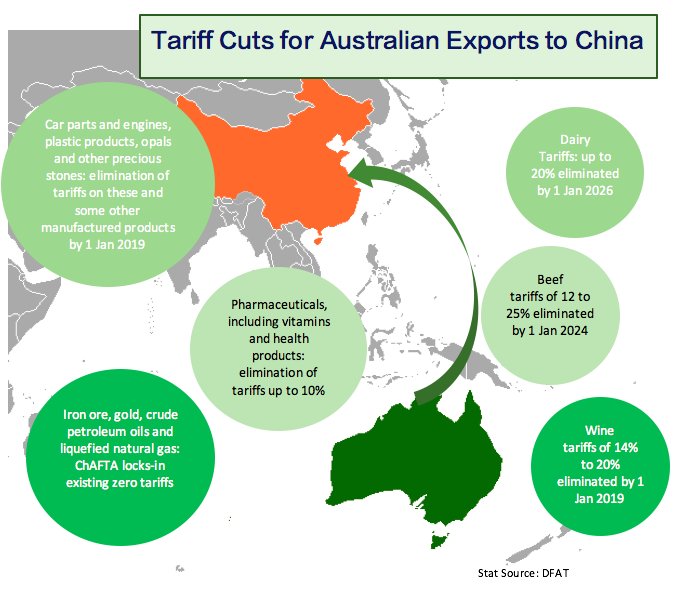

ChAFTA also cut 7,289 individual Chinese tariffs. Additional tariff cuts have been progressively made, the latest occurring in January 2016. Further cuts are expected to occur in January of each year. China will benefit from tariff cuts of up to 5%, while Australian exporters will benefit from tariff cuts of up to 30%. A snapshot of these benefits is below:

The benefits for exporters have already become apparent. In 2014, China spent $45 billion more on Australian goods than Australia spent on Chinese goods. In the past five years, two-thirds of the increase in Australia’s export activity has been driven by China, which has increased its purchase of Australian goods and services by $50 billion. Limits on Chinese investments and workers entering Australia are included in the agreement in order to protect the local market and local businesses.

This mutual access to the Australian and Chinese markets has fueled the success of many Australian exporters. The opportunities remain. 61% of Australian exporters are positive about the impact of ChAFTA.

If you are interested in exporting to China, there is no better time. Contact your Calibre Advisor for expert advice.

Important Disclaimer: Readers should not act solely on the basis of the material on this page. Items herein are general comments only and do not constitute or convey advice. Legislation and proposals of legislation are also subject to constant change. We therefore recommend that formal advice be sought before acting in any of the areas. This news article is issued as a guide to the readers. Calibre Business Advisory Pty Ltd and its associated entities disclaims any losses that may be incurred as a result of the reader undertaking any action based on this article.